Top Reasons to Pick VA Home Loans for Your Next Home Acquisition

Top Reasons to Pick VA Home Loans for Your Next Home Acquisition

Blog Article

Recognizing How Home Loans Can Facilitate Your Trip Towards Homeownership and Financial Security

Navigating the intricacies of home fundings is important for any individual aspiring to accomplish homeownership and develop monetary security. As we take into consideration these crucial components, it ends up being clear that the course to homeownership is not simply about securing a lending-- it's concerning making notified choices that can form your monetary future.

Sorts Of Home Loans

Traditional loans are a preferred choice, usually calling for a greater credit rating and a down repayment of 5% to 20%. These fundings are not insured by the federal government, which can cause more stringent credentials requirements. FHA finances, backed by the Federal Real Estate Administration, are made for novice buyers and those with reduced credit report, enabling deposits as reduced as 3.5%.

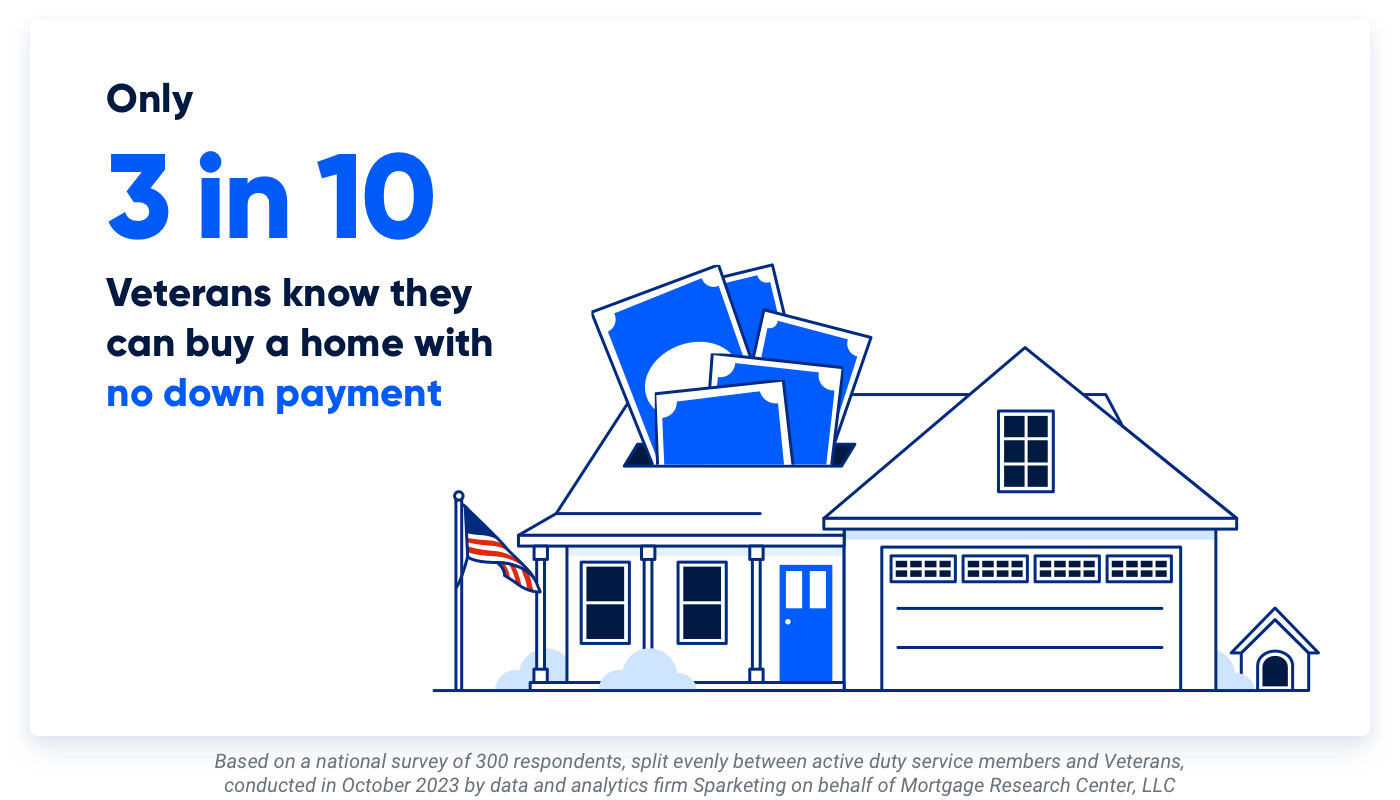

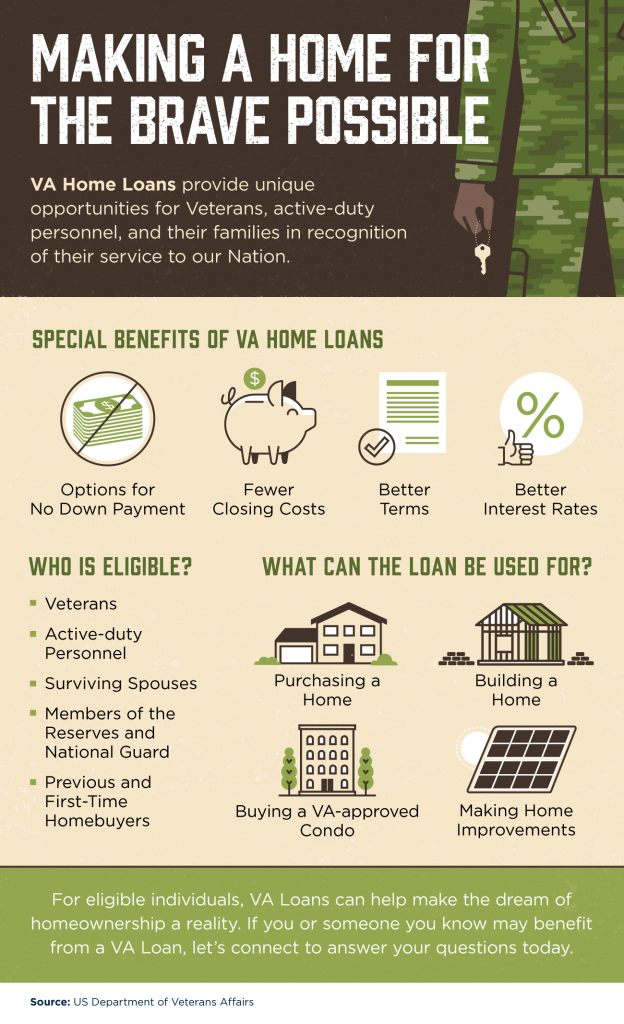

VA financings, available to veterans and active-duty army workers, use desirable terms such as no private home mortgage and no down payment insurance policy (PMI) USDA loans accommodate rural buyers, promoting homeownership in much less densely booming areas with low-to-moderate income levels, likewise calling for no deposit.

Last but not least, variable-rate mortgages (ARMs) provide lower initial prices that change gradually based on market problems, while fixed-rate home mortgages provide stable monthly repayments. Understanding these options enables potential property owners to make educated choices, aligning their financial goals with one of the most suitable car loan type.

Comprehending Rate Of Interest

Rate of interest rates play a crucial duty in the home car loan procedure, significantly influencing the overall price of loaning. They are essentially the cost of obtaining cash, shared as a percentage of the financing amount. A reduced rates of interest can cause substantial financial savings over the life of the loan, while a higher price can lead to increased monthly settlements and overall rate of interest paid.

Passion rates vary based upon different elements, consisting of financial problems, rising cost of living rates, and the monetary plans of reserve banks. Borrowers ought to know taken care of and variable rate of interest. A fixed rate remains continuous throughout the car loan term, giving predictability in regular monthly payments. On the other hand, a variable price can transform periodically based upon market problems, which might lead to reduced initial repayments yet possible boosts gradually.

Comprehending how rate of interest work is critical for prospective home owners, as they straight influence cost and economic planning. It is suggested to compare rates from various loan providers, as also a mild difference can have a considerable effect on the overall cost of the funding. By keeping up with market patterns, customers can make enlightened decisions that align with their economic objectives.

The Application Process

Navigating the home loan application process can at first appear challenging, however understanding its vital components can streamline the trip. The initial action includes event required documents, including evidence of income, income tax return, and a list of responsibilities and assets. Lenders need this information to evaluate your financial stability and credit reliability.

Next, you'll need to choose a lender that lines up with your monetary needs. Research different home mortgage items and rate of interest rates, as these can substantially affect your month-to-month payments. When you select a lending institution, you will certainly finish a formal application, which might be done online or personally.

As soon as your application is authorized, the lending institution will release a funding estimate, describing the terms and prices connected with the home loan. This crucial paper permits you to assess your choices and make notified choices. Successfully browsing this application process lays a solid foundation for your trip towards homeownership and monetary stability.

Managing Your Home Loan

Managing your home loan efficiently is crucial for preserving monetary wellness and making sure long-lasting homeownership success. A proactive approach to look at here now home loan administration involves understanding the terms of your finance, including rates of interest, settlement routines, and any type of potential fees. Regularly reviewing your mortgage statements can help you stay informed about your staying balance and repayment background.

Creating a budget that accommodates your mortgage repayments is important. Make certain that your monthly budget consists of not just the principal and interest yet additionally building taxes, property owners insurance policy, and upkeep prices. This comprehensive view will prevent economic stress and unexpected costs.

This strategy can significantly minimize the total interest paid over the life of the loan and reduce the repayment duration. It can lead to lower month-to-month settlements or a more positive lending term.

Finally, keeping open interaction with your lender can offer quality on options offered ought to financial problems develop. By actively handling your home loan, you can improve your monetary stability and reinforce your course to homeownership.

Long-Term Financial Benefits

Homeownership offers considerable long-lasting monetary advantages that prolong beyond simple sanctuary. Among one of the most significant advantages is the capacity for property gratitude. In time, actual estate normally appreciates in worth, allowing homeowners to develop equity. This equity acts as a monetary asset that can be leveraged for you can look here future investments or to finance significant life occasions.

Additionally, homeownership gives tax advantages, such as home loan passion reductions and real estate tax reductions, which can considerably reduce a home owner's taxable revenue - VA Home Loans. These deductions can bring about significant cost savings, improving total economic security

Moreover, fixed-rate home mortgages safeguard house owners from climbing rental costs, guaranteeing predictable month-to-month settlements. This security permits individuals to spending plan effectively and prepare for future expenses, helping with long-lasting economic goals.

Homeownership likewise promotes a feeling of community and belonging, which can cause increased civic involvement and support networks, even more contributing to economic well-being. Eventually, the financial advantages of homeownership, consisting of equity growth, tax obligation benefits, and expense stability, make it a keystone of long-lasting financial safety and security and riches build-up for individuals and family members alike.

Verdict

In verdict, recognizing home financings is necessary for navigating the course to homeownership and accomplishing monetary security. In addition, reliable mortgage administration and recognition of long-lasting economic benefits contribute substantially to view it building equity and cultivating area engagement.

Navigating the complexities of home fundings is vital for any person striving to accomplish homeownership and establish economic security. As we think about these important components, it ends up being clear that the path to homeownership is not simply concerning safeguarding a lending-- it's about making informed options that can shape your financial future.

Recognizing exactly how passion prices function is important for potential home owners, as they directly affect cost and financial preparation.Managing your home mortgage properly is vital for keeping financial wellness and guaranteeing long-term homeownership success.In conclusion, comprehending home lendings is crucial for browsing the path to homeownership and achieving economic stability.

Report this page